Electronic invoicing reform

Initially scheduled for July 2024, this new reform will require all VAT-registered businesses to use electronic invoicing (e-invoicing).

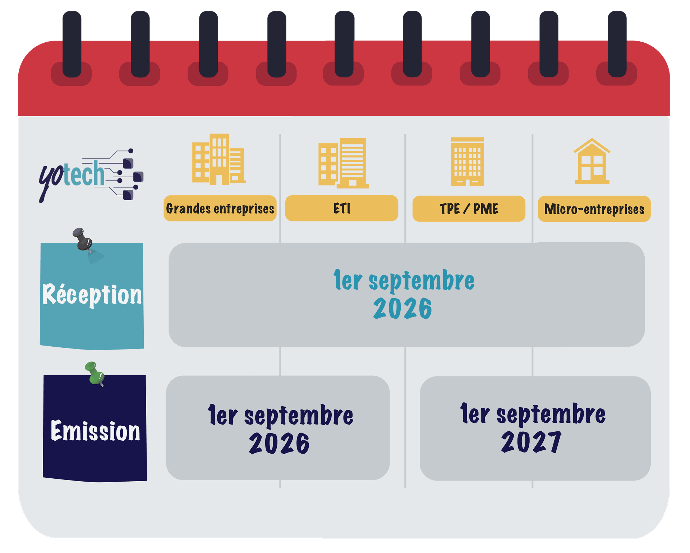

In order to allow structures to comply in the best possible conditions, the General Directorate of Public Finances (DGFiP ) has finally decided to postpone the deadlines to 2026 (subject to the adoption of the 2024 Finance Act).

In addition to reception, the obligation to issue invoices in electronic format will be staggered according to the type of business.

Yotech helps you to anticipate the new reform on electronic invoices

Thanks to the Odoo solution, Yotech can help you comply now. In addition to comprehensive business management, Odoo includes EDI (electronic data interchange) functionality, which enablesautomated administration between companies, as required in France for tax audit purposes or to facilitate management.

Electronic invoicing of your documents such as customer invoices, credit notes or supplier invoices is one of the applications of EDI. Each PDF generated from Odoo contains a Factur-X XML file (for interoperability purposes). The Factur-X (PDF/A-3) option also enables validation checks to be carried out on the invoice and a PDF/A-3 compliance file to be generated, as required by platforms such as Chorus Pro.

Why choose Yotech?

- We analyse all your processes

- We identify the features you need

- We provide long-term support

- Our solutions are tailored to your business

- We train and support you

- We provide long-term support

Anticipate your transition today!

Make an appointment with our Odoo consultants!

FR :

FR :